Market Commentary

As speculated in the last few market updates, we have seen a soft market throughout the northern summer months. Our funds have been positioned accordingly and have continued to significantly outperform the market. The Digital Asset Fund was down 0.45% with BTC and ETH both down over 8% for the month, representing a 7.55% outperformance. The Market Neutral Fund produced a very credible 5.08% return over the period.

Macro

- In the macro arena, the Nasdaq and global stock markets seem to be in a state of euphoria, driven by the AI narrative and FOMO kicking in.

- Investors seem overoptimistic that rates will come down sooner than later. But September is traditionally a poor month for risk assets, and any sign of bad news may trigger some sort of retracement.

- We expect inflation and employment figures to be particularly scrutinized by market participants following higher than expected PPI and non-farm payrolls in August.

Crypto

- Even with the accomplishment of significant industry specific milestones, including a US Courts ruling against the SEC in both the Grayscale and XRP cases, and the submissions from many of the world’s largest asset managers, including BlackRock, VanEck and Fidelity, for a spot Bitcoin ETF, the cryptocurrency market has shown weakness.

- We believe that the market is going through a cleansing from the previous cycle with liquidations caused by the overhype and hubris at that time. These include significant sales from the FTX, Silk Road and Mount Gox debacles. Legal action from the SEC against Binance does seem to have legs and an adverse outcome against the world’s largest exchange could be the final obstacle facing the market.

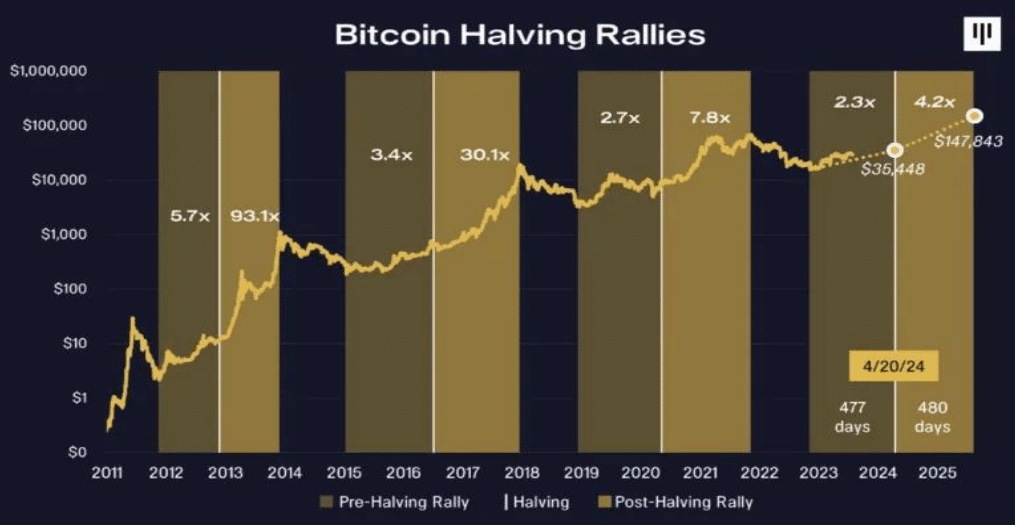

- Once this backlog of asset sales is cleared, and the Binance case is settled, we believe the new flows of money coming into the market will lead to significant price appreciation. For more information on the halving and its intricacies, please refer to the piece we wrote and sent out with the July market update. Please refer to the following link if you are unable to locate this piece: https://mhcdigitalgroup.com/news/unlocking-the-future-of-bitcoin-the-halving-cycle/

- Speculation around the outcome of the spot Bitcoin ETFs has become almost obsessive in the crypto world. We are convinced the SEC will be made to approve these vehicles, thereby giving regulatory clarity and acceptance, leading to significant inflows of capital into the sector.

- We do, however, believe that approvals will not come through until early next year, and that the market is overoptimistic that the approvals happen in the short-term. With the delays, we expect to see weakness in the market to compensate for the overoptimistic views.

- There are two approvals pending. One for an Ethereum Futures ETF and one for a Bitcoin Spot ETF. The Spot ETF can be considered the Holy Grail, but the Futures ETF is a steppingstone to that outcome. We currently have a BTC Futures ETF. We expect that the Bitcoin Spot ETF gets delayed to next year but that the Ethereum Futures ETF will get approved much sooner. We are therefore more bullish on ETH and the Grayscale Ethereum Trust than we are on BTC and the Grayscale Bitcoin Trust, and have positioned accordingly. We shall see if our expectations are correct over the coming months.

- In line with these milestones, one of our largest positions since the turn of the year has been in the Grayscale Trusts which we entered at significant discounts. The discounts existed because the trust was unable to buy and sell BTC and ETH to match the buying and selling of the trust units. Grayscale submitted a filing to the SEC to convert the Grayscale Bitcoin Trust (GBTC) into a spot-based Bitcoin ETF in October 2021. This was rejected, resulting in Grayscale suing the SEC. In August 2023, Grayscale won that case, resulting in a significant narrowing of the discount. The discount still stands above 20% and we believe as the process continues, we will see it contract further. At that point, we will exit the position.

- For more detail on how the trust works and the developments we have predicted, and which have materialized, please refer to the following link: https://mhcdigitalgroup.com/news/grayscales-win-a-turning-point-for-digital-asset-regulation/

Register your interest in MHC Digital Asset Fund, MHC Market Neutral Fund or in any other of MHC Digital Group’s products by contacting our team at enquiries@mhcdigitalgroup.com

Disclaimer

This document has been prepared by MHC Digital Finance Pty Ltd (“MHC Digital Finance”). The information contained herein should be considered as preliminary and indicative and does not purport to contain all the information that any recipient may desire. In all cases, recipients should conduct their own investigations and analysis. No liability whatsoever is accepted and neither MHC Digital Finance nor any members of the MHC Digital Finance nor any of their respective directors, partners, officers, affiliates, employees, contractors, representatives or other agents (“Agents”) is or will be making any warranty, representation or undertaking (expressed or implied) concerning the accuracy or truthfulness of, any of the information, forecasts, projections or of any of the opinions contained in this document or any other written or oral statement provided or for any errors, omissions or misstatements contained herein. Nothing contained in this document is, or should be relied upon as (i) the giving of financial product or any other advice by MHC Digital Finance nor as constituting an offer or invitation to enter into any transaction or investment, or (ii) a promise or representation as to any matter whether as to the past or the future. No representation, warranty, undertaking or other assurance is hereby given by MHC Digital Finance, any member of the MHC Digital Finance or any of their Agents that any of the forecasts or projections contained herein will be realised. Recipients of this document in jurisdictions outside Australia should inform themselves about and observe any applicable legal requirements in their jurisdictions. In particular, the distribution of this document may in certain jurisdictions be restricted by law. Accordingly, recipients represent that they are able to receive this document without contravention of any applicable legal or regulatory restrictions in the jurisdiction in which they reside or conduct business. No part of this document may be shown or distributed to third parties or reproduced, stored or transmitted in any form or by any means, elections, mechanical, photocopying, recording or otherwise without the prior written permission of MHC Digital Finance.