Historical Success: Halving as a Catalyst for Growth

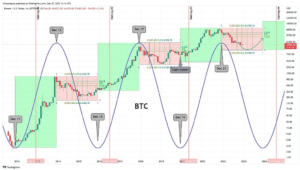

The price action surrounding previous Bitcoin halving’s has been nothing short of remarkable. Let’s delve into the historical performance of Bitcoin after each halving event:

2012 Halving: The first Bitcoin halving took place in November 2012 when the block reward reduced from 50 to 25 Bitcoins. Following this event, Bitcoin’s price experienced a gradual but significant ascent. Over the course of the next year, Bitcoin surged from around $12 to reach an all-time high of approximately $1,150 in December 2013. This staggering price increase marked a remarkable growth of over 9,500% in the 13 months following the event.

2016 Halving: The second halving occurred in July 2016, reducing the block reward from 25 to 12.5 Bitcoins. Bitcoin’s price did not immediately react, but it embarked on a remarkable bull run in the months and years that followed. From around $650 before the halving, Bitcoin soared to an all-time high of approximately $20,000 in December 2017. This phenomenal surge represented a staggering growth of over 3,000% over the period.

2020 Halving: The most recent halving event took place in May 2020, reducing the block reward from 12.5 to 6.25 Bitcoins. This halving was particularly significant as it occurred amidst increasing institutional interest in Bitcoin. On this occasion, as investors tried to front run the predicted price action and the price of Bitcoin saw a gradual rise in the months leading up to the halving, and afterward, it experienced a remarkable rally. From around $8,000 prior to the halving, Bitcoin reached an all-time high of approximately $64,000 in April 2021. This incredible surge marked an astounding growth of over 800% in less than a year.

A Glimpse into the Future: Halving in 2024

Based on the price action of previous halving’s, it is evident that they have acted as significant catalysts for Bitcoin’s bull markets. While the immediate price reaction may vary, the subsequent months and years have seen substantial growth and new all-time highs.

We note that the percentage appreciation in price has diminished with each halving, but the impact is still significant. We also note that the price movement happens earlier in the cycle as investors pre-position their portfolios with more history to look at.

In conclusion we believe that the halving creates a significant and objective catalyst for market strength relative to other risk assets. As such, we will be positioning our portfolio accordingly. We believe that the event occurring in March 2024 will provide a strong tailwind for the market as a whole from the fourth quarter of 2023 as market participants pre-position for the event.

Register your interest in MHC Digital Asset Fund, MHC Market Neutral Fund or in any other of MHC Digital Group’s products by contacting our team at enquiries@mhcdigitalgroup.com

Disclaimer

This document has been prepared by MHC Digital Finance Pty Ltd (“MHC Digital Finance”). The information contained herein should be considered as preliminary and indicative and does not purport to contain all the information that any recipient may desire. In all cases, recipients should conduct their own investigations and analysis. No liability whatsoever is accepted and neither MHC Digital Finance nor any members of the MHC Digital Finance nor any of their respective directors, partners, officers, affiliates, employees, contractors, representatives or other agents (“Agents”) is or will be making any warranty, representation or undertaking (expressed or implied) concerning the accuracy or truthfulness of, any of the information, forecasts, projections or of any of the opinions contained in this document or any other written or oral statement provided or for any errors, omissions or misstatements contained herein. Nothing contained in this document is, or should be relied upon as (i) the giving of financial product or any other advice by MHC Digital Finance nor as constituting an offer or invitation to enter into any transaction or investment, or (ii) a promise or representation as to any matter whether as to the past or the future. No representation, warranty, undertaking or other assurance is hereby given by MHC Digital Finance, any member of the MHC Digital Finance or any of their Agents that any of the forecasts or projections contained herein will be realised. Recipients of this document in jurisdictions outside Australia should inform themselves about and observe any applicable legal requirements in their jurisdictions. In particular, the distribution of this document may in certain jurisdictions be restricted by law. Accordingly, recipients represent that they are able to receive this document without contravention of any applicable legal or regulatory restrictions in the jurisdiction in which they reside or conduct business. No part of this document may be shown or distributed to third parties or reproduced, stored or transmitted in any form or by any means, elections, mechanical, photocopying, recording or otherwise without the prior written permission of MHC Digital Finance.